This is a public announcement for information purposes only and is not a prospectus announcement and does not constitute an invitation or offer to acquire, purchase or subscribe for securities not for distribution outside India

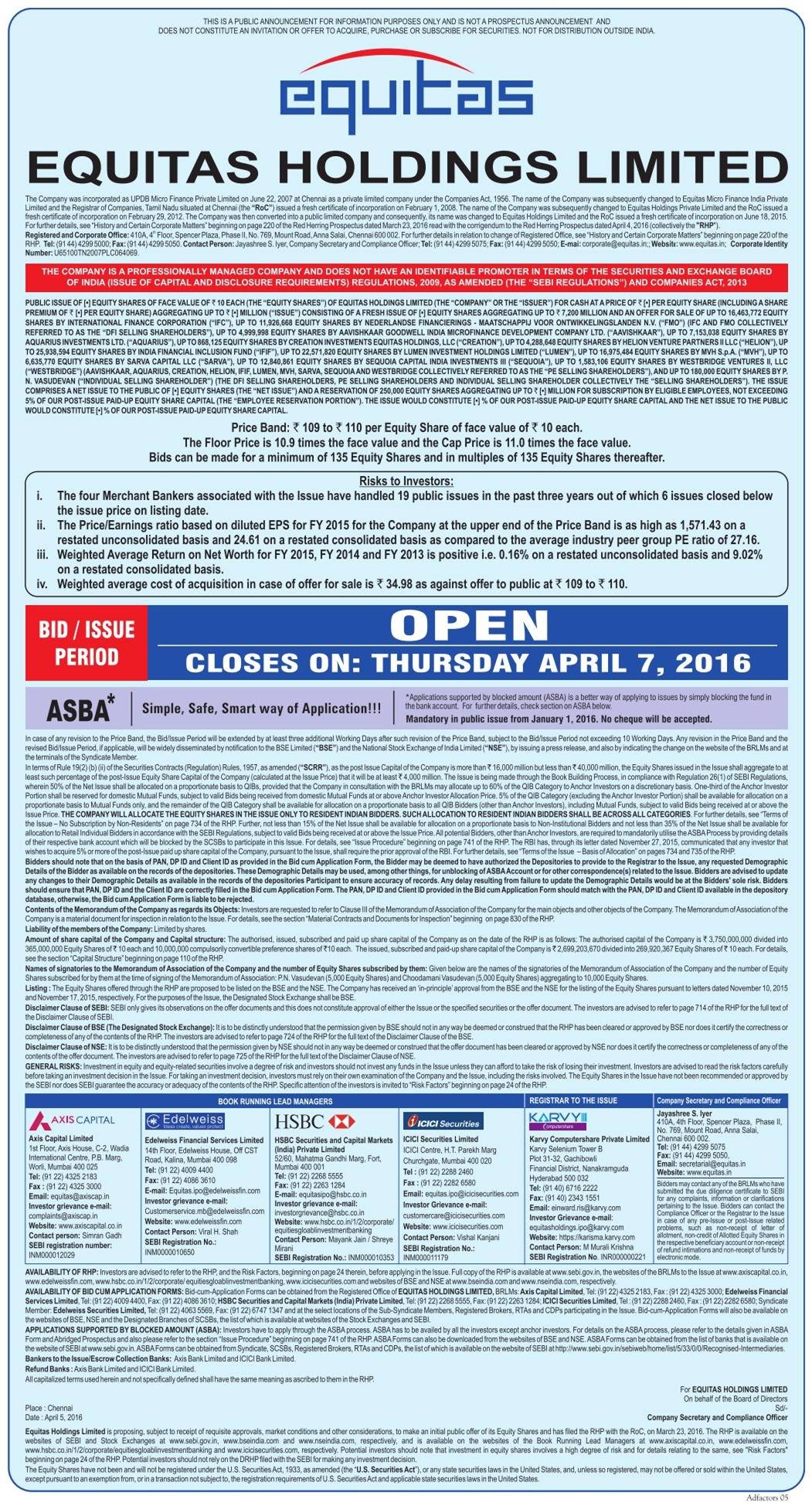

EQUITAS HOLDINGS LIMITED

The company is a professionally managed company and does not have an identifiable promoter in terms of the securities and exchange board of India (issue of capital and disclosure requirements) regulations, 2009, as amended (the “SEBI Regulations”) and companies act, 2013

Public issue of [•] equity shares of face value of 210 each (the “equity shares”) of Equitas Holdings Limited (the “company” or the “issuer”) for cash at a price of per equity share (including a share premium of Rs. (•) per equity share) aggregating up to Rs. (•) million (“issue”) consisting of a fresh issue of [•] equity shares aggregating up to Rs. 7,200 million and an offer for sale of up to Rs. 6,463,772 equity shares by international finance corporation (“IFC”). Up to Rs. 1,926,668 equity shares. (IFC and FMO collectively referred to as the DFI selling shareholders”) up to Rs. 4,999,998 equity shares by Aavishkaar Goodwell India Micro Finance Development Company Ltd. (“Aavishkaar”). Upto Rs. 7,153,038 equity shares by Aquarius Investments Ltd. (“Aquarius”). Up to Rs. 868,125 equity shares by creation investments Equitas Holdings, LLC (“creation”). Upto Rs. 4,288,648 equity shares by Helion venture Partners (I) LLC (“Helion”) Up to Rs. 25,938,594 equity shares by India Financial Inclusion Fund (“IFIF”), up to Rs. 2,571,820 equity shares by Lumen Investment Holdings Limited (“Lumen”). Up to Rs. 6,975,484 equity shares by MVH (“MVH”), up to Rs. 6,635,770 equity shares by Sarva Capital LLC (“Sarva”), Upto Rs. 2,840,861 equity shares by Sequoia Capital India Investments LLC (“Sequoia”), up to Rs. 1,583,106 equity shares by Westbridge Ventures (I), LLC (“Westbridge”) (Aavishkaar, Aquarius, Creation, Helion, IFIF, Lumen, MVH, Sarva. Sequoia and Westbridge collectively referred TOAS the “pre selling shareholders – 1. And up to 180.000 equity shares by P. N. Vasudevan (“Individual selling Shareholder”) (the DFI selling shareholders. Pre selling shareholders and individual selling shareholder collectively the selling shareholders”) the issue comprises a net issue to the public of (•) equity shares (the “net issue”) and a reservation of 250.000 equity shares aggregating up to Rs. [•] million for subscription by eligible employees, not exceeding 5% of our post-issue paid-up equity share capital the “employee reservation portion:). The issue would constitute in] % of our post-issue paid-up equity share capital and the net issue to the public would constitute [1 % of our post-issue paid-up equity share capital].

Price Band: Rs. 109 to Rs. 110 per Equity Share of face value of Rs. 10 each.

The Floor Price is 10.9 times the face value and the Cap Price is 11.0 times the face value.

Bids can be made for a minimum of 135 Equity Shares and in multiples of 135 Equity Shares thereafter.

Risks to Investors:

- The four Merchant Bankers associated with the Issue have handled 19 public issues in the past three years out of which 6 issues closed below the issue price on listing date.

- The Price/Earnings ratio based on diluted EPS for FY 2015 for the Company at the upper end of the Price Band is as high as 1,571.43 on a restated unconsolidated basis and 24.61 on a restated consolidated basis as compared to the average industry peer group PE ratio of 27.16.

- Weighted Average Return on Net Worth for FY 2015, FY 2014 and FY 2013 is positive i.e. 0.16% on a restated unconsolidated basis and 9.02% on a restated consolidated basis. iv. Weighted average cost of acquisition in case of offer for sale is Rs. 34.98 as against offer to public at Rs. 109 to Rs. 110.

OPEN

CLOSES ON: THURSDAY APRIL 7, 2016

ASBA*

Simple, Safe, Smart way of Application!!!

*Applications supported by blocked amount (ASBA) is a better way of applying to issues by simply blocking the fund in the bank account. For further details check section on ASBA below.

Mandatory in public issue from January 1, 2016. No cheque will be accepted.

In case of any ream to the Price Band, the Bid issue Period may be extended by at least three additional Working Days after such reason or the Price Band. Subject to the Bid Issue Period not exceeding 10 working days. Any reason the Price Band and me revised Before issue Period, if applicable will be widely disseminated by notification to the BSE Limited (“BSE”) and the National Stock Exchange of India Inked (“NSE”), by issuing a press release, and also by indicating the change on the webbed of the BRLIAs and at the terminals or the Syndicate Member.

In terms & Rule 19(2)(b) (a) of the Securities Contracts (Regulation) Rules. 1957. as amended (“HSCRR”). As the past Issue Capital the Company s more than Rs. 16,000 million but less than Rs. 40,000 won the Equity Shares issued in Issue shall aggregate to at least such percentage of the post-Issue Equity Share Capital of the Company (conciliated at the Issue Price) that A will be at least Rs. 4,000 million. The Issue being made through the Book Bulking Process in compliance with Regulation 26(1) of SEBI Regulations, wherein 50% of the Net Issue shall be allocated on a proportionate basis malls, provided that the Company in consultation with the BRLMs may allocate up to 60% of the 01B Category to Anchor Investors on a discretionary basis. One-third of the Archer Investor Portion shall be reserved domestic Mutual Funds, subject to valid Bids being received from domestic Mutual Funds at or above Anchor Investor Price 5% of the GIB Category (excluding the Anchor Invest*: Portion) shall be available for allocation on a the basis to Mutual Funds any and the remainder of the 018 Category shall be available for allocation an a proportionate bass to al 01B Bidders Maher than Anchor Investors). It’s saying Mutual Funds subject to valid Bids being received at or above the issue Price. THE COMPANY WILL ALLOCATE THE EQUITY SHARES IN THE ISSUE ONLY TO RESIDENT INDIAN BIDDERS. SUCH ALLOCATION TO RESIDENT INDIAN BIDDERS SHALL BE ACROSS ALL CATEGORIES. Further, details see 'Terms of the Issue -No Substock by Non-Residents' on page 734 of the RHP. Further, not less than 15% of the Net Issue should be available for allocation on a proportionate basis to Non-Institutional Bidders and not less than 35% of the Net Issue shall be available for allocation to Retail Individual Bidders in accordance with the SEBI Regulations.

Bidders should note that on the basis of PAN, OP 10 and Client 10 as provided in the Bid cum Application Form, the Bidder may be deemed to have authorized the Depositories to provide to the Registrar to the Issue, any requested Demographic Details of the Bidder as available on the records of the depositories. These Demographic Details may be used, among other things for unblocking of ASBA Account or for other correspondence(s) related to the Issue. Bidders are advised to update any changes to their Demographic Details as available in the records of the depositories Participant to ensure accuracy of records. Any delay resulting from failure to update the Demographic Details would be at the Bidders' solo risk. Bidders should ensure that PAN. DP ID and the Client ID are correctly filled in the Bid cum Application Form. The PAN, DP ID and Client ID provided in the Bid cum Application Form should match with the PAN, DP ID and Client ID available in the depository database, otherwise the Bid cum Application Form is liable to be rejected. Contents of the Memorandum of the Company as regards its Objects: Investors are requested to refer to Clause III of the Memorandum of Association of the Company for the man objects and other objects of IT-Company The Memorandum of Association or the Company is a material document for rejection in relation to the Issue For details see the section 'Material Contracts and Documents for Inspection' beginning on page 830 of the RHP.

Liability of the members of the Company: Limited by shares.

Amount of share capital of the Company and Capital structure: The authorized issued subscriber and paid up share capital of the Company as on the dale of the RHP is as follows. The authorized capital of the Company is Rs. 3,750,000,000 divided into 365,003,000 Equity Shares of 210 each and 10000.000 compulsory convent* preference shares of 210 each. The issued subscribed and paid-up share capital of the Company is Rs. 699,203070 divided into Rs. 69,920,367 Equity Shares of 210 each for details; see the section 'Capital Structure beginning on page 110 of the RHP

Names of signatories to the Memorandum of Association of the Company and the number of Equity Shares subscribed by them: Given below are the names of the signatories of the Memorandum of Association of the Company and the number of Equity Shares subscribed [ruby them at the Line of signing of the Memorandum of Association. P.N. Vasudevan (5.000 Equity Shares) and Thoodamare Vasudevan (5.000 Equity Shares) aggregating to CLOW Equity Shares.

Listing: The Equity Shares offered through the RHP are proposed lo be listed on the BSE and the NSE. The Company has received an approval from the BSE and the NSE for the listing of the Equity Shares pursuant to senders dated November 10, 2015 and November 17.2015, respectively. For the purposes of the Issue, the Designated Stock Exchange shall be BSE.

Disclaimer Clause of SEBI: SEBI only does observations on the offer documents and this does not constitute approval of either the Issue or the specified securities & the offer document the 'movers are advised to refer to page 714 of the RHP for the full text of the Disc/31meg Clause of SEBI.

Disclaimer Clause of BSE (The Designated Stock Exchange): It is to be distinctly understood that the person given by BSE should not in any way be deemed or construed that the RHP has been &eared or approved by BSE nor does a certify the correctness & completeness of any or the contents of the RHP. The investors are advised to refer to page 724 of the RHP for the full text of the Disclaimer Clause of the BSE.

Disclaimer Clause of NSE: It is to be correctly understood that the permission Seven by NSE should not HI anyway be deemed & construed that the offer document has been cleared or approved by NSE nor does it caddy the correctness or completeness & any cite contents of the offer document. The investors are advised to refer to page 725 of the RHP for the full text of the Disclaimer Clause of NSE

GENERAL RISKS: Investment inequity and equity-Sated fie antes involve a degree of risk and investors should not invest any funds in the Issue unless they can afford to take the risk of losing their investment Investors are advised to read the risk factors carefully before taking an investment decision in the Issue For taking an investment decision. Investors must rely on their own examination of the Company and the Issue, including the risk involved. The Equity Shares in the Issue have not been recommended or approved by SEBI nor does SEBI guarantee INR accuracy or adequacy of the contents of the RHP Specific attention of the investors is invited to 'Ask Factors- beginning on page 24 of the RHP