Newspaper : Times of India Newspaper

Edition : Bangalore

Date of Publishing: 15-07-2017

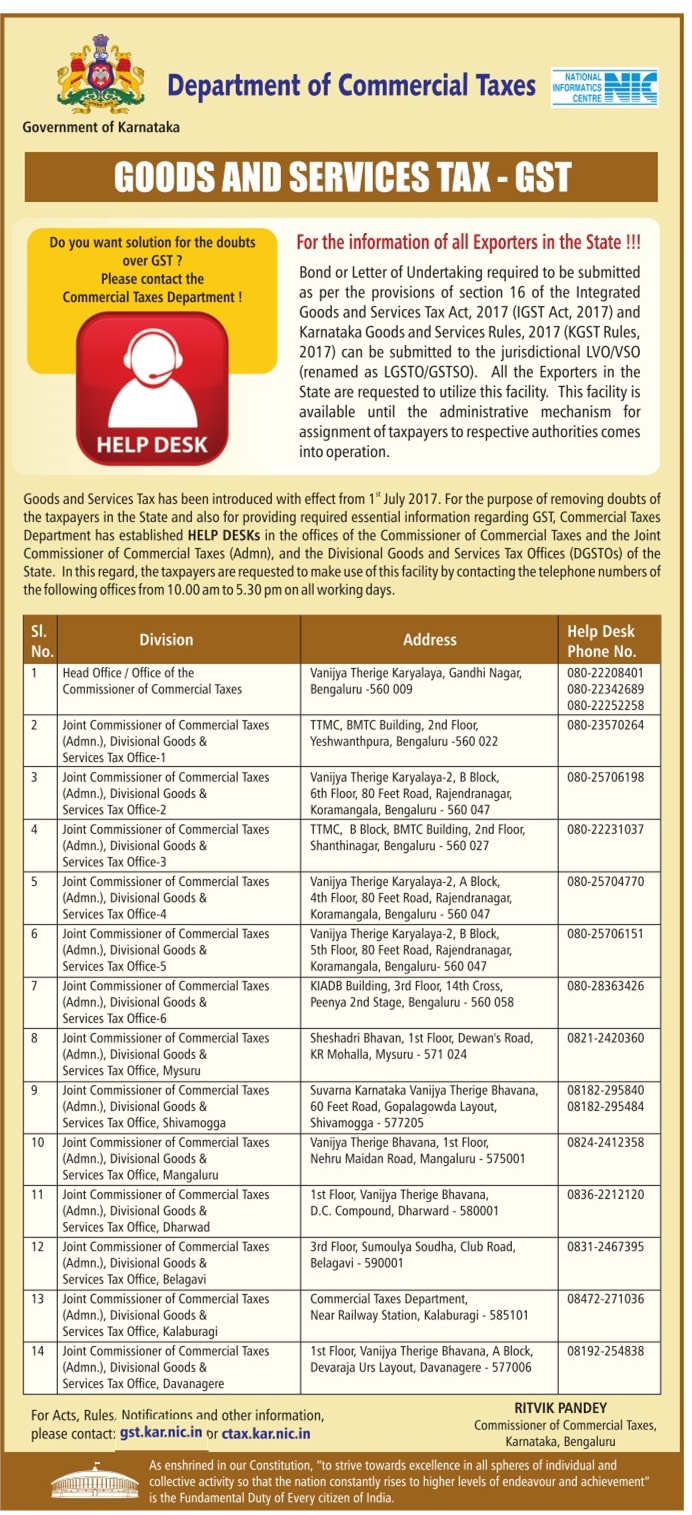

Department Of Commercial Taxes GST – For the information of all Exporters in the State Ad

Government of Karnataka

Department of Commercial Taxes

Goods and Services Tax – GST

For the information of all Exporters in the State!!

Bond or Letter of Undertaking required to be submitted as per the provisions of section 16 of the Integrated Good and Services Tax Act, 2017 (IGST Act, 2017) and Karnataka Goods and Services Rules, 2017 (KGST Rules, 2017) can be submitted to the jurisdicational LVO/VSO (renamed as LGSTO/GSTSO). All the Exporters in the State are requested to utilize this facility. This facility is available untill the administrative mechanism for assignment of taxpayers to respective authorities comes into operation.

Goods and Services Tax has been introduced with effect from 1st July 2017. For the purpose of removing doubts of the taxpayers in the State and also for providing required essential information regarding GST, Commercial Taxes Department has established HELP DESKs in the offices of the Commissioner of Commercial Taxes and the Joint Commissioner of Commercial Taxes (Admn), and the Divisional Goods and Service Tax Offices (DGSTOs) of the State. In this regard, the taxpayers are requested to make use of this facility by contracting through telephone numbers.

Ritvik Pandey

Commissioner of Commercial Taxes, Karnataka, Bengaluru

As enshrined in our Constitution, “to strive towards excellence in all spheres of individual and collective activity so that the nation constantly rises to higher levels of endeavour and achievement” is the Fundamental Duty of every Citizen of India.