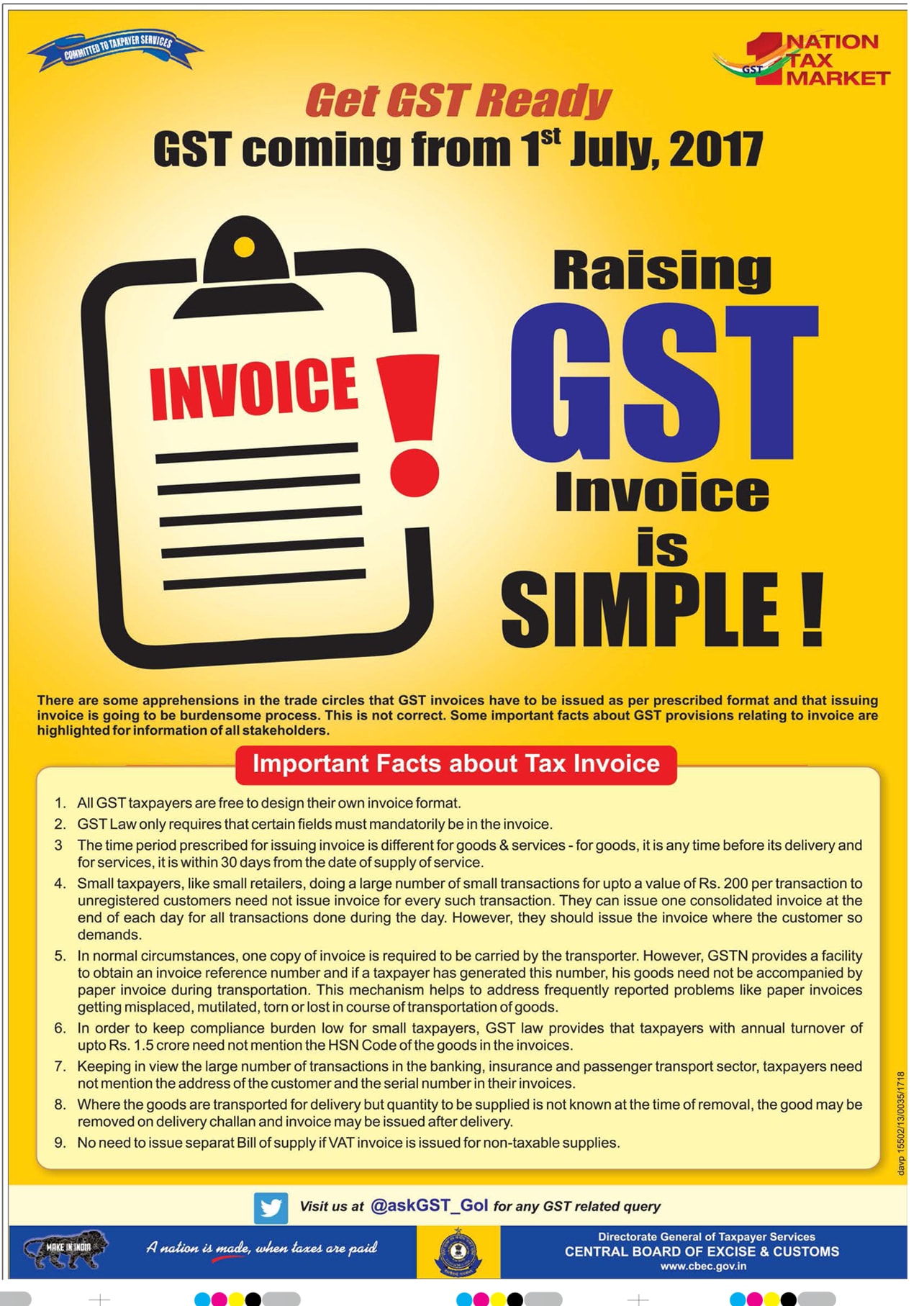

Raising GST Invoice Is Simple – Central Board of Excise & Customs Ad

Get GST Ready

GST coming from 1st July, 2017

Important Facts about Tax Invoice

- All GST taxpayers are free to design their own invoice format.

- GST Law only requires that certain fields must mandatorily be in the invoice.

- The time period prescribed for issuing invoice is different for goods & services – for goods, it is any time before its delivery and for services, it is within 30 days from the date of supply of service.

- Small taxpayers, like small retailers, doing a large number of small transactions for upto a value of Rs. 200 per transaction to unregistered customers need not issue invoice for every such transaction. They can issue one consolidated invoice at the end of each day for all transactions done during the day. However, they should issue the invoice where the customer so demands.

- In normal circumstances, one copy of invoice is required to be carried by the transporter. However, GSTN provides a facility to obtain an invoice reference number and if a taxpayer has generated this number, his goods need not be accompanied by paper invoice during transportation. This mechanism helps to address frequently reported problems like paper invoices getting misplaced, mutilated, torn or lost in course of transportation of goods.

- In order to keep compliance burden low for small taxpayers, GST law provides that taxpayers with annual turnover of upto Rs. 1.5 crore need not mention the HSN Code of the goods in the invoices.

- Keeping in view the large number of transactions in the banking, insurance and passenger transport sector, taxpayers need not mention the address of the customer and the serial number in their invoices.

- Where the goods are transported for delivery but quantity to be supplied is not know at the time of removal, the good may be removed on delivery challan and invoice may be issued after delivery.

- No need to issue separate Bill of supply if VAT invoice is issued for non-taxable supplies.

Visit us on Twitter at @askGST_Gol for any GST related query or to know how to raise GST Invoice.

Directorate General of Taxpayer Services

Central Board of Excise & Customs

www.cvec.gov.in

A nation is made, when taxes are paid

This Advertisement published in Deccan Chronicle Newspaper in Hyderabad Edition.

Date of Publishing: 14-6-2017